If you’re a small business owner, chances are you’ve said this to yourself in the last month:

“I’m handling sales, onboarding, scheduling, client comms, and still trying to grow the business.”

That’s exactly where I was.

I wasn’t lazy. I wasn’t disorganized. I just didn’t have systems. And every time I tried to hire someone, it either:

- Made things more complicated

- Took more of my time

- Didn’t stick

Eventually, I hit a wall. I had to figure out how to stop being the bottleneck, build a system that could scale, and get back to working on the business, not just in it.

This post breaks down what actually worked — tools, tactics, hires, and how it all fits together.

How to Increase Operational Efficiency for Your Small Business

Here are key steps to help you eliminate inefficiencies and optimize your small business operations, so you can run a smoother, more profitable business in 2026:

1. Take a Step Back and Assess What’s Working (and What’s Not)

If you want to know how to run a successful small business, the first step is understanding where your current operations stand and identifying inefficiencies.

Before making any changes, you need a clear picture of how your small business operations are currently running, and you can get that by conducting an in-depth audit.

How to Conduct a No-Nonsense Business Audit

✅ Track Employee Workflows: Use tools like Hubstaff to see where time is actually going. You’d be surprised how much of your team’s time is spent on redundant or low-value tasks.

✅ Audit Your Tech Stack: Are you paying for software you don’t use? A report by Blissfully found that businesses waste an average of $135,000 per year on unused software subscriptions. Run a check using tools like Zylo to cut unnecessary expenses.

✅ Ask Your Customers: Your small business operations directly impact customer experience. Use surveys or review analysis (via tools like Google My Business Insights) to find common complaints or areas where service could be improved.

✅ Calculate Your Efficiency Score: Businesses that track Key Performance Indicators (KPIs) are expected to grow faster than those that don’t. Some key ones to measure:

- Order fulfillment speed (Time from order placement to delivery)

- Customer service response time (How long does it take to resolve issues?)

- Revenue per employee (Are you getting the most out of your team?)

2. Automate Repetitive Tasks to Boost Efficiency

If you’re looking for ways to increase operational efficiency, automation is one of the easiest and most effective solutions.

The less time you or your team spend on busy work, the more time you have to actually grow your business. And the best part? You don’t need a huge budget to make it happen.

Where to Start Automating?

- Finances & Payments – Use tools like QuickBooks to send invoices and track expenses automatically. No more chasing payments!

- Customer Support – Set up a simple chatbot (like Drift or Intercom) to answer FAQs so customers aren’t left waiting.

- Scheduling – Let Calendly handle meeting bookings – no more back-and-forth emails.

- Marketing – Platforms like HubSpot can send follow-ups and personalize emails automatically.

Start by identifying the tasks that take up too much of your time, and focus on automating the ones that slow you down the most. Choose tools that integrate easily with what you already use, so you’re not adding extra complexity.

Important: Don’t try to automate everything at once. Start small, test what works, and build from there.

Finally, make sure your team knows how to use these tools effectively. The goal isn’t just to save time but to run smoother, smarter small business operations where everything works more efficiently.

3. Outsource Strategically to Scale Faster

As a small business owner, you probably wear multiple hats – handling sales, customer service, marketing, and admin work all at once. But here’s the truth: doing everything yourself is slowing your business down.

Knowing how to manage a small business successfully means recognizing when to delegate, outsource, or automate tasks that don’t require your direct involvement.

Outsourcing certain elements of your small business operations doesn’t mean losing control – it means freeing yourself up for the work that actually grows your business. The key is knowing what to outsource and where to find the right help.

What Tasks Should You Outsource?

- Repetitive Admin Work – Data entry, email management, and appointment scheduling can all be outsourced to a virtual assistant.

- Executive Assistance – Hiring an outsourced executive assistant can take a huge load off your plate by managing your calendar, handling emails, and keeping your daily operations organized, so you can focus on big-picture growth instead of small tasks.

- Accounting & Bookkeeping – Instead of spending hours on financial reports, let an expert handle it while you focus on strategy.

- Marketing & Content Creation – Social media, blog writing, and graphic design can be done by specialists, giving your brand a professional edge.

- Customer Support – Hiring an offshore team for customer inquiries ensures fast response times without hiring a full in-house team.

Prefer a quick breakdown? Our Social Media Manager explains it all in this short video:

How to Outsource Without the Headaches

It’s simple: get in touch with Pavago!

Finding the right people for the job can be overwhelming, but Pavago takes the guesswork out of hiring.

We connect small businesses with top-tier offshore talent – helping you find skilled professionals for admin work, customer support, marketing, bookkeeping, and more.

No endless hiring process, no payroll headaches; just expert help, ready to go. Plus, we handle compliance and onboarding so you can focus on scaling your business, not managing paperwork.

Want to find the right talent without the hassle?

Pavago can help.

4. Strengthen Financial Management to Stay Profitable

Cash flow issues are one of the biggest reasons small businesses struggle. In fact, a U.S. Bank Study found that 82% of small businesses fail due to poor cash flow management.

The good news? A few simple financial tweaks can keep your business in the green and help you scale your small business operations with confidence.

Smart Strategies to Improve Cash Flow

- Automate Invoicing & Payments – Late payments can crush your cash flow. Tools like QuickBooks or FreshBooks can automatically send invoices and payment reminders, ensuring you get paid on time.

- Monitor Expenses Closely – Small leaks sink big ships. Use expense-tracking apps like Expensify or Wave to keep tabs on spending and spot unnecessary costs.

- Negotiate Better Payment Terms – If vendors expect payment in 15 days but clients take 45 days to pay you, you’re stuck in a cash flow crunch. Try renegotiating terms with suppliers to better match your revenue cycle.

- Plan for Taxes Year-Round – Instead of scrambling at the last minute, set aside a portion of revenue each month for taxes. Cloud-based accounting software can estimate tax liabilities in real-time, keeping you ahead.

5. Improve Customer Experience Without Adding More Work

Great customer experience isn’t just about being friendly – it’s about making things easy and seamless for your customers.

86% of buyers are willing to pay more for a better experience, yet many small businesses struggle to keep up because they’re stretched too thin.

The good news? You don’t need a massive support team to deliver top-notch service. A few smart tweaks can make a huge difference.

Simple Ways to Improve Customer Experience

- Automate Responses – A chatbot (like Drift or Intercom) can answer FAQs instantly, directing complex issues to a human when needed.

- Personalize Interactions – A CRM (like HubSpot or Zoho) tracks customer history, so you can tailor responses instead of using generic replies.

- Offer Self-Service Options – A well-organized FAQ page, video tutorials, or AI-powered help desks let customers find solutions quickly without waiting for support.

- Follow-Up & Show You Care – A simple thank-you email, feedback request, or personalized discount keeps customers engaged and encourages repeat business.

- Outsource Customer Support – If handling support in-house is overwhelming, hiring through offshore customer support outsourcing companies can provide 24/7 coverage at a lower cost, keeping customers happy without overloading your team.

Hire top-tier offshore customer support specialists within 3 weeks or less.

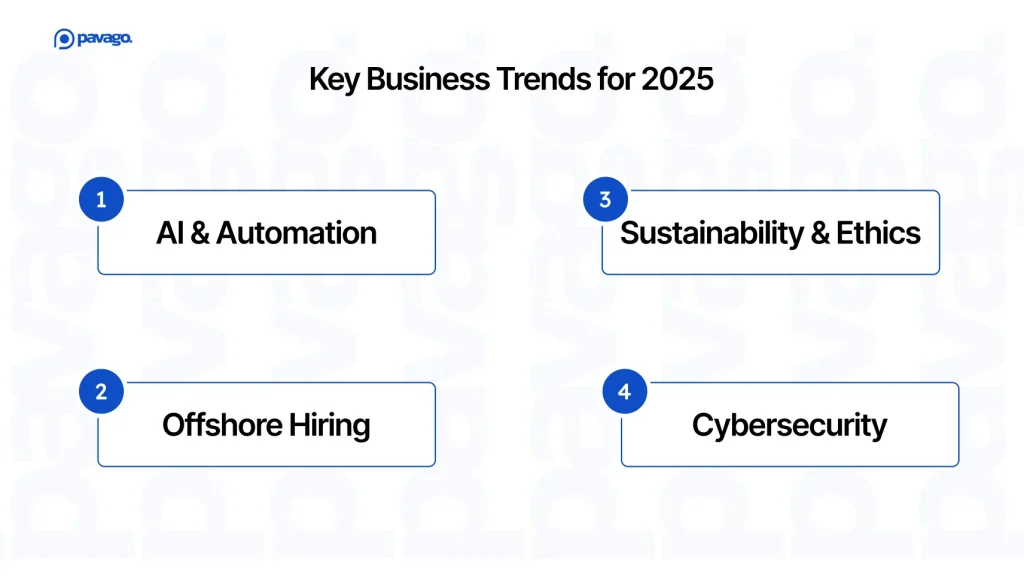

6. Stay Ahead by Keeping Up with Industry Trends

The business landscape is changing faster than ever. What worked last year might not work in 2026. Small businesses that adapt to new trends early have a competitive edge, while those that resist change often struggle to keep up.

If you’ve ever wondered, “How to improve my small business?” you should know that staying updated on industry trends and adapting early can give you a major competitive edge.

Keeping an eye on emerging trends isn’t just about streamlining your small business operations – it’s also about staying ahead of your competitors and unlocking new opportunities before they become mainstream.

How to Stay Ahead Without Feeling Overwhelmed

✅ Follow Industry News – Subscribe to newsletters or follow business influencers in your niche. Staying informed doesn’t have to take hours—just a quick daily check-in can keep you ahead.

✅ Network with Other Business Owners – Join online communities, attend local events, or connect on LinkedIn to learn from peers who are facing similar challenges.

✅ Test & Adapt – Not every trend will apply to your business, but keeping an open mind and testing small changes can help you stay competitive without unnecessary risks.

7. Proactively Manage Compliance & Regulations

Ignoring compliance can lead to fines, legal trouble, and operational setbacks. From taxes and employment laws to data privacy, staying ahead of regulations is a must for smoother small business operations.

Having clear policies in place can help your business improve operational processes and avoid costly compliance mistakes.

How to Stay Compliant Without the Stress

- Stay Updated – Subscribe to industry newsletters or set Google Alerts to track changes in laws affecting your business.

- Use Compliance Tools – Platforms like TrustArc (for data privacy) or Gusto (for HR laws) can help you stay on top of legal requirements.

- Get Expert Advice – If you handle payroll, contracts, or international hiring, consult a compliance expert to avoid costly mistakes.

- Train Your Team – Ensure employees understand key regulations, like data security or workplace policies, to reduce risks.

Wrapping It Up

Running a business can feel like a never-ending to-do list, but streamlining your small business operations doesn’t have to be complicated. The key isn’t working harder – it’s working smarter. By making small but meaningful changes, you can improve business operations and create a more profitable, stress-free workflow.

If you need a little help along the way – whether it’s outsourcing admin tasks, customer support, or bookkeeping – Pavago’s got your back.

We’ll connect you with top offshore talent, so you can spend less time buried in work and more time building your business.